Released in the early hours Monday (June 5), the state budget included a noteworthy addition — a $6 million grant pilot program designed to reimburse eligible individuals for their student loan payments.

The program was originally a bill that passed the House on Thursday (June 1) before being added to the two-year, $51 billion budget starting July 1. If passed without amendments, the Office of Higher Education (OHE) will oversee the pilot program’s establishment to reimburse certain residents for student loan payments by January 1, 2024.

Every participant will be eligible to receive up to $5,000 annually and no more than $20,000, over four years of participation in the program. Awards will be given out on a first-come, first-served basis to eligible applicants.

To be eligible, participants must be residents of the state for at least five years; have an adjusted gross income of less than $125,000 for individual filers and $175,000 for joint filers; have a student loan from any public or private college; hold an occupational or professional license; and have left college in good academic standing before graduation.

In exchange for this generous payout funded by taxpayers — including those who did not pursue further education after high school — recipients will have to volunteer a grueling fifty unpaid hours for each year of participation.

Meanwhile, OHE may use up to two percent of the funds appropriated for program administration, promotion and recruitment activities.

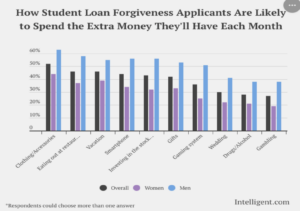

It should be noted that when President Joe Biden announced his plan to reduce student loan debt by up to $20,000, data analysts at Intelligent surveyed those that applied or planned to apply, and found that 73% of applicants said they would likely spend their extra money on nonessentials, including vacations, smartphones, or drugs/alcohol.

The survey also showed that twice as many Democrats than Republicans admitted it would be acceptable to spend the money on non-essentials. Men were more likely than women (84%-65%) to spend on non-essentials.

Additionally, 75% of recipients plan on spending money on groceries, 66% on housing and 65% to pay credit card debt.

And the final insult: those who opted to not further their education after high school or have already paid off their student loans are not eligible for this benefit.