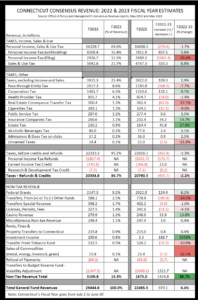

- According to Connecticut’s Office of Policy and Management’s and Comptroller’s latest estimates, overall revenue grew 4.4% from Fiscal Year 2022 to 2023 with a rise in non-tax revenue overcoming a decrease in tax revenue.

- Total tax revenue shrunk 2.2%, from $20,790 million to $20,334 million.

- Revenue from personal incomes tax withholding jumped 5.8%, while revenue from personal incomes tax filing dropped 26.6%.

- Overall, personal income tax in Connecticut decreased 5.1% from FY2022 to FY2023 and accounted for nearly half, 47.9% of FY2023 General Fund revenues.

- Sales & use tax revenue increased 6.8% from FY2022-23 and accounted for 21.7% of FY2023 General Fund revenues.

- Tax revenue excluding personal income and sales tax decreased 1% from FY2022-23 and accounted for 25.4% of General Fund revenues.

- The estate tax saw a revenue increase of 27.9% from FY2022-23. Revenue from the estate tax still only made up 0.9% of General Fund revenues in FY2023, a slight bump from 0.7% in FY2022.

- Revenue from non-tax sources (federal grants, other fund transfers, licenses, permits, fees, etc.) grew 85.7% from FY2022 to FY2023 and accounted for 13.3% of General Fund revenues.

- This 85.7% increase was largely due to less revenue being placed in Connecticut’s Budget Reserve Fund. In FY2022, Connecticut put $2,669 million into the Reserve fund, while only $1,347 million was put in for FY2023. The Reserve Fund is meant to soften revenue volatility from year to year, which allows government programs to continue in the event of an economic downturn, without changing tax policy.

- Revenue from Connecticut’s investments spiked from $3.3 million in FY2022 to $190 million in FY2023, an increase of 5658%! Despite this spike, investments only accounted for 0.9% of General Fund revenue.

Connecticut’s Office of Policy and Management’s Consensus Revenue reports can be viewed here.

Click image to expand