Gov. Ned Lamont announced in late December that he would use federal COVID relief funds to retroactively increase the Earned Income Tax Credit to 41.5 percent for roughly 198,000 families in Connecticut who filed for the EITC in 2020.

The move will cost $75 million, according to the governor’s press release, and would boost the average credit by a few hundred dollars to a total of $925, according to Lisa Tepper-Bates, president and CEO of the United Way of Connecticut. The credit will be granted when individuals file their tax returns in 2022.

“That’s a month of rent, that’s two months of utility bills, that’s two months of daycare for a toddler, that’s a critically-needed repair to a car that provides transportation to work,” Tepper-Bates said during a briefing with Lamont and Democrat leaders yesterday.

The EITC is a federal and state tax credit for those who earn less than $52,000 per year, depending on the number of children in the household. Connecticut increased its EITC rate from 23 percent to 30.5 percent in legislation last year, but the governor is awarding the extra credit based on the 2020 EITC rate.

Senate President Pro-Tem Martin Looney, D-New Haven, thanked Lamont for using federal funds for the purpose of raising the EITC and said that he hopes the legislature can move forward to “make the EITC level permanent.”

Looney said the state’s EITC was temporarily lowered to 23 percent during the 2017 budget negotiations between Democrats and Republicans.

“These dollars will make a difference,” said Sen. John Fonfara, D-Hartford, co-chair of the Finance, Revenue and Bonding Committee. “I think I probably represent more of these families as a percentage of the population I represent than about anyone.”

Fonfara’s co-chair on the Finance Committee, Rep. Sean Scanlon, D-Guilford, says the increased EITC will help reduce poverty and child poverty in Connecticut. “I think that’s something all of us should be focused on, whether you’re a Democrat or a Republican, we have got to get Connecticut kids out of poverty,” Scanlon said.

However, Republican House Minority Leader Vincent Candelora, R-North Branford, said these targeted tax cuts don’t make up for state policies that hinder Connecticut’s job and income growth.

“As a whole, Connecticut residents should be disappointed that the singular approach from Governor Lamont and legislative Democrats to provide resident with financial relief focuses on delivering money to targeted groups of people rather than fixing their policies that have made our state an unaffordable place to live and create jobs,” Candelora said in a press statement.

Since the 2008 recession, Connecticut’s economic and job growth has been among the slowest in the nation, never fully recovering the jobs lost during that recession before the COVID pandemic hit in 2020. The closure of businesses due to lockdowns forced hundreds of thousands of people out of work and onto unemployment.

Since businesses began reopening, Connecticut job numbers have begun to return, but roughly 100,000 people disappeared from the labor force and businesses continue to struggle to find help, even after increasing wages to help spur interest.

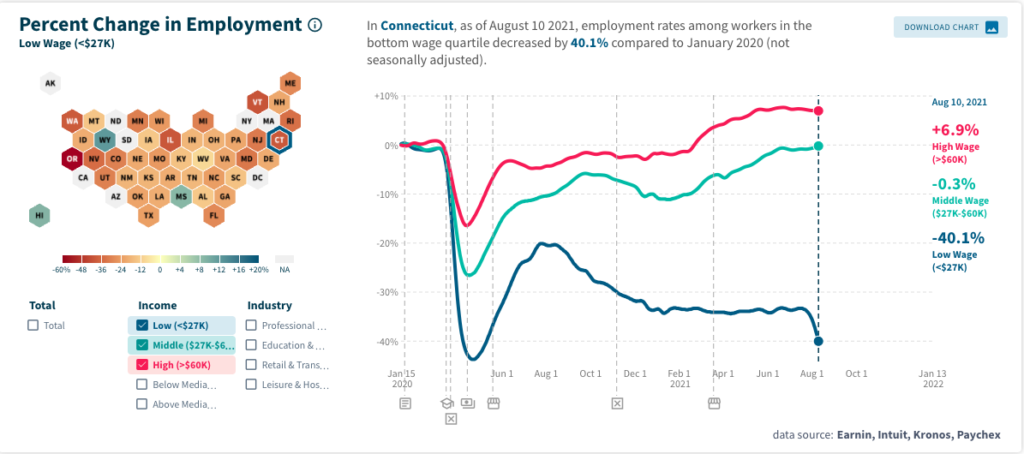

While jobs in middle to high income brackets have returned to pre-pandemic levels, low-income jobs – including jobs that would be worked by residents receiving the EITC — remain down 40 percent, according to Track the Recovery, a data website run by Harvard, Brown University and the Bill & Melinda Gates Foundation. However, the EITC is available to those in the middle income range listed by Track the Recovery.

“Connecticut faces significant challenges, and today’s news conference won’t help main street businesses fill the glut of job openings, nor will it provide lasting respite from the array of taxes and fees that constrict opportunity and growth,” Candelora said.

“People are deserving of a raise, and that’s what we’re trying to do here,” Lamont said during the press conference. “It’s also part of getting our economy moving again. We took a body blow, as you know, over the past couple years, and I have to do everything I can to get people back to work.”

“Work should pay, and we will continue to try to lift people up every day with initiatives like this,” Lamont said.