Connecticut made a historic $1.6 billion payment toward its $40 billion pension debt thanks to the state’s volatility cap, and that payment is expected to achieve significant savings over the next four years, according to the Office of Fiscal Analysis.

The pension payoff will reduce Connecticut’s pension costs – part of the state’s fixed costs – by $290 million by 2026, a welcome reprieve after more than a decade of annual cost increases, but the savings won’t be enough to keep Connecticut’s fixed costs from taking up more than 57 percent of the state’s budget.

For years, the growth of Connecticut’s fixed costs — which consist of debt payments, pensions and retiree healthcare, Medicaid and adjudicated payments — outpaced revenue growth by roughly 2.8 percent annually creating a built-in structural deficit for the state.

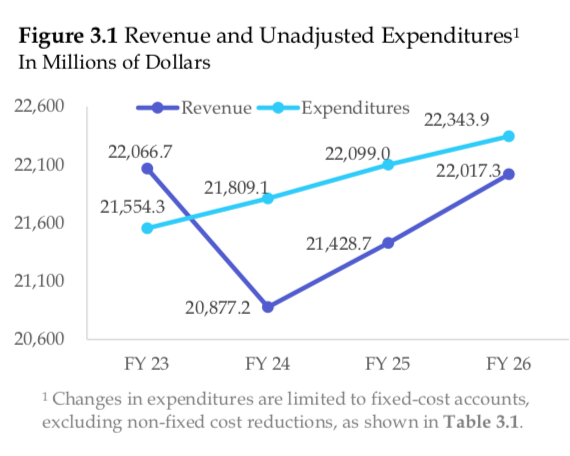

But the pension payoff, combined with rapidly rising revenue projections, has narrowed that gap and by 2026 – if projections pan out – revenue will outpace fixed costs by an average of .4 percent, according to the report.

“A significant contributor to this structural balance is a slowdown in fixed cost growth in the out-years,” the OFA wrote in its Fiscal Accountability Report. “This is due in large part to a reduction in projected annual contribution to the State Employee Retirement System and the Teachers Retirement System as a result of additional deposits into the system from an accumulated excess in the Budget Reserve Fund.”

Connecticut’s escalating pension payments due to decades of underfunding have been a perennial thorn in the side for lawmakers and governors crafting the state budget.

The savings on pension payments will help offset significant projected increases for some of Connecticut’s other fixed costs, namely Medicaid and retiree health benefits, which are expected to increase by a combined $975 million by 2026.

The costs of retiree health care will top out at over $1 billion by 2026 and Medicaid will account for $4.7 billion by that same year. OFA anticipates that an expected state employee retirement wave in 2022 will increase the total costs of retiree health care, along with the increasing cost of medical and prescription services.

Overall, Connecticut’s fixed costs will grow by roughly $1.65 billion during that time and will make up 57.5 percent of the General Fund’s budget, meaning that for every tax dollar paid by Connecticut residents, 57.5 cents will be already spent.

Likewise, the pension payoff will save the Special Transportation Fund $20 million and the STF’s cumulative balance is expected to grow to $1.2 billion by 2026.

However, the growth of the STF’s debt service costs for transportation bonds will significantly outpace revenue growth. Annual debt service is projected to grow by 8.8 percent compared to a 3.5 percent growth in revenue and debt service will top out at over $1 billion by 2026.

The OFA projects the costs for public transportation – one of the STF’s fixed costs – will grow by $132 million.

Of course, all of these are estimates based on revenue and expense projections now, and Connecticut’s budgetary fortunes are largely dependent on the financial sector where declines in Wall Street earnings can leave unanticipated budget gaps.

The report notes that, “it is uncertain how several revenue and expenditure trends, which contribute to surpluses in the biennium, will continue in the out-years.”

Connecticut was able to bridge a $2.5 billion budget deficit in the current biennium thanks to the influx of federal COVID relief dollars and higher than expected tax revenue, creating budget surpluses in fiscal years 2022 and 2023.

When the federal dollars run out, however, the state will once again be looking at yearly deficits, ranging from nearly $1 billion in 2024 to $326 million in 2026.

Connecticut’s budget reserve fund, or rainy day fund, is fully funded with more than $3 billion which can be used to help pay off those deficits and, potentially, pay down more of Connecticut’s pension costs in fiscal years 2022 and 2023, which would further increase future pension savings.

TOUGH LOVE

November 23, 2021 @ 10:26 am

It IS BALONEY TO CALL AN ADDITIONAL PENSION DEPOSIT A REDUCTION IN THE PENSION’S “COST” ………. AREN’T WE LOSING THE SAME AMOUNT OF INVESTMENT EARNINGS IF THE MONEY HAD NOT BE DEPOSITED INTO THE PENSION AND INSTEAD INVESTED OUTSIDE THE PENSION?

iT’S ACCOUNTING GIMMICKRY AND CLEARLY HOODWINKING THE tAXPAYERS, WHILE KEEPING THE sTATE’S PUBLIC SECTOR UNIONS/WORKERS HAPPY WITH VERY VERY GENEROUS PENSIONS AND BENEFITS LONG GONE FROM THE PRIVATE SECTOR.

TO REALLY LOWER THE PENSION PALN’S COST ………… MATERIALLY REDUCE FUTURE THE SERVICE ACCRUAL RATE FOR ALL CURRENT WORKERS.

Mark

November 23, 2021 @ 3:46 pm

What I am hearing is that this 1.6Billion cannot be returned to the taxpayers, and can’t be used to help the state in any practical way. This 1.6 Billion, like every other penny the state finds, has to be sent to the retired public employees down in Florida. It really is as simple as that.