A long-standing state statute from 1957 requires labor unions to file annual reports with Connecticut’s Department of Labor, but DOL has no record of any such reports, according to a Freedom of Information request.

The Legal Director with Connecticut’s DOL initially indicated there were no records applicable to Yankee Institute’s request and said, “To my knowledge, we have received no reports.”

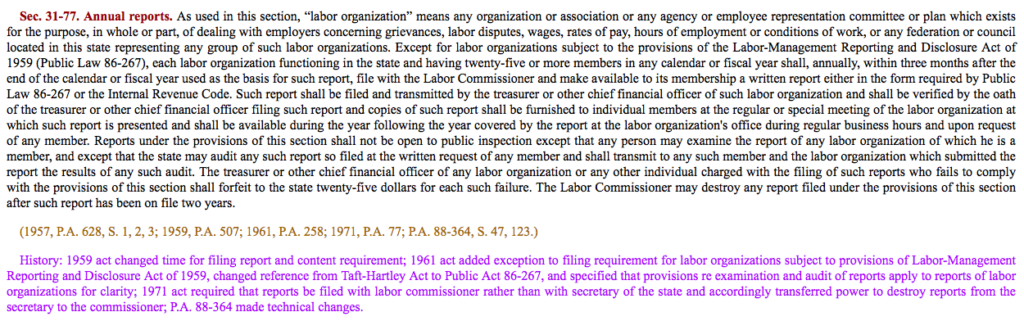

Under the terms of state statute, any labor union with 25 or more members must file an annual financial report with the DOL. Failure to do so results in a $25 fine.

The Connecticut law applies to purely public-sector unions, exempting private sector unions that are covered under the federal Labor Management Reporting and Disclosure Act of 1959, a law passed meant to curb union corruption at the time.

Public sector unions who also represent private sector workers such as AFSCME or the American Federation of Teachers, have to file federal financial disclosure documents every year that are publicly searchable.

However, unions exclusively representing public sector workers, including teachers, firefighters and police do not have to file those federal documents and, under Connecticut’s existing statute, would have to file their financial records with the state.

The law was a union transparency measure meant to assure all union members “that they know what their dues are used for,” according to the legislative history, and was agreed to by unions in Connecticut. The law was meant to address corruption in labor union finances and some lawmakers at the time felt the statute did not go far enough.

The financial statements submitted to the state – unlike federal union financial statements – are not available to the public but only available for union members and for the state to conduct audits at the request of a union member.

Although the bill allows the DOL commissioner to destroy the records after two years, DOL confirmed that they had no record of receiving the annual reports, levying fines or destroying the records.

DOL said they are focused on ensuring people get their unemployment payments processed during a time of high unemployment.

“CT DOL remains focused on providing unemployment assistance to the more than 100,000 people still recovering from the pandemic and out employment programs that get our workforce back into the market,” DOL Communications Director Juliet Manalan wrote in an email. “We are not aware of any complaints related to this statute.”

There’s little to indicate that current union members are even aware of the 64-year-old statute that still remains on the books, let alone file a complaint over it.

DOL also said that the statute “appears antiquated” and is not meant for the public, but the federal reporting law, passed just two years later, remains in effect and the federal government continues to enforce it and receive union financial reports.

Members of exclusively public-sector unions, had they known of the statute, might be interested to find out how their dues money is being spent.

According to The U.S. Office of Labor-Management Standards there were over 120 indictments, prosecutions and convictions of union officials in 2020 largely related to embezzlement, fraud and other financial crimes.

**Frank Ricci contributed to this article**