Despite comments from Gov. Ned Lamont and Democratic legislative leaders saying the General Assembly would not take up the Transportation and Climate Initiative program this year, language in the budget implementer bill allowing state department commissioners to contract with other states is raising concerns among lawmakers and opponents of TCI that it could be a backdoor way for Connecticut to enter the regional cap and trade program.

The TCI program is a regional cap and trade system meant to cap carbon emissions from vehicles. Supporters say the program will decrease carbon emissions in the state and bring in additional revenue, while opponents say it will essentially be another tax on gasoline and potentially lead to fuel shortages.

Although the program was originally meant to include thirteen states, thus far only Massachusetts, Rhode Island, Connecticut and Washington D.C. have signed onto the memorandum of understanding with TCI.

Connecticut and Rhode Island, however, require the program to be passed by the legislature, but there is concern among lawmakers and opponents of TCI that language in the budget implementer may provide a way for the Commissioner of Department of Energy and Environmental Protection Katie Dykes – TCI’s biggest proponent – to get around legislative approval.

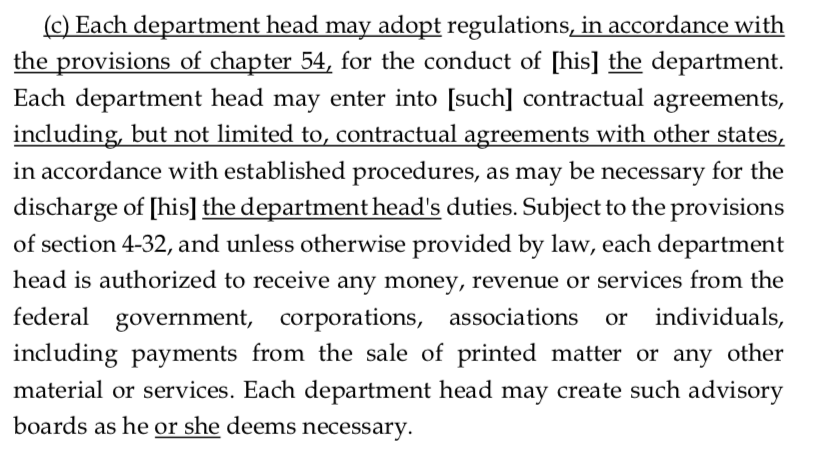

Section 221 expands existing state law by allowing department commissioners to unilaterally enter into contracts with other states. While the broad language could apply to almost anything, including purchasing agreements between states, some worry the provision could, in theory, be used to enter into TCI’s regional cap and trade system.

“While budget implementers are infamous for circumventing the legislative process on legislation that did not have the support needed to pass into law on their own,” said Chris Herb, President of the Connecticut Energy Marketers Association. “We are concerned that ambiguous language contained in this year’s bill could be manipulated to violate the trust of the public and the majority of Democratic legislators who are opposed to the TCI gasoline tax.”

The language also raised the ire of Senate Republicans who argued against that provision and several others on the Senate floor.

“I don’t know what somebody is thinking about in this section,” Sen. Craig Miner, R-Litchfield, said during Senate debate on the implementer. “It allows agency heads to enter into agreements, I would argue, without legislative approval because this is our approval. A ‘yes’ vote on this is a legislative approval for that authority.”

“So, I guess if the governor of Massachusetts decides he wants to do TCI, the commissioner of DEEP can sign on with the state of Massachusetts,” Miner said.

House Republican Leader Vincent Candelora, R-North Branford, said the original memorandum of understanding between Connecticut and TCI required the legislature approve the program, but the implementer language could provide a workaround if the MOU is amended.

“It’s possible it’s a backdoor way to get TCI because it allows contracting without legislative approval,” Candelora said. “The original framework requires the legislature to approve any compact, but you could argue they could amend the MOU and get around the legislature.”

The TCI program was declared dead for this legislative session after legislative leaders said it wouldn’t be brought up for a vote in either chamber. Although Gov. Lamont said he would continue to fight for the program, he admitted that it would not happen this year.

Progressive Democrats were upset over Gov. Lamont blocking new or higher taxes on the wealthy and Senate President Pro-Tem Martin Looney, D-New Haven, said the TCI program amounted to a “regressive tax,” according to CT Mirror.

Nevertheless, following an impasse over the marijuana legalization bill, House Speaker Matthew Ritter, D-Hartford, said that TCI could possibly be included in the budget implementer, a massive document directing how the budget is meant to implemented that often contains provisions that were never approved by the General Assembly known as “rats.”

Environmental groups immediately began issuing calls to action to push for TCI to be included in the implementer or in a special session, and Lamont remarked during a press conference that he would like to see the matter taken up in special session.

Republicans appeared to take the threat seriously, warning that the TCI program – or language making it possible – could sneak its way into the implementer and flagged the language in section 221 as problematic heading into the special session.

Several suprise provisions in the implementer have already stirred some controversy, including a provision withholding casino revenue from school districts with a Native American mascot and pay-as-you-throw trash collection.

“After legislative leaders indicated that TCI was not going to be in the budget, it would be an outrage if the administration were to try to use language in the implementer to justify a new tax on diesel and gasoline,” Herb said.