Since its inception in 1991, Connecticut’s income tax has been raised four times, new brackets have been added, and the income tax has become the state’s largest source of revenue, projected to bring in $9.4 billion in fiscal year 2021 alone.

But Connecticut’s income tax has also had some unintended consequences over its 30-year history, according to a new report released by Yankee Institute entitled Revenue Ratchet: Connecticut’s Income Tax at 30.

Namely, it has pushed the state toward relying more heavily on a shrinking group of high-income taxpayers who are, according to the data, finding ways to shield themselves from the state’s increasing tax burden and causing volatile swings in Connecticut’s budget projections.

Only two other states – New York and California – rely on their state income tax for revenue as heavily as Connecticut and as top-margin tax rates have increased so has the state’s reliance on high-wealth individuals and families.

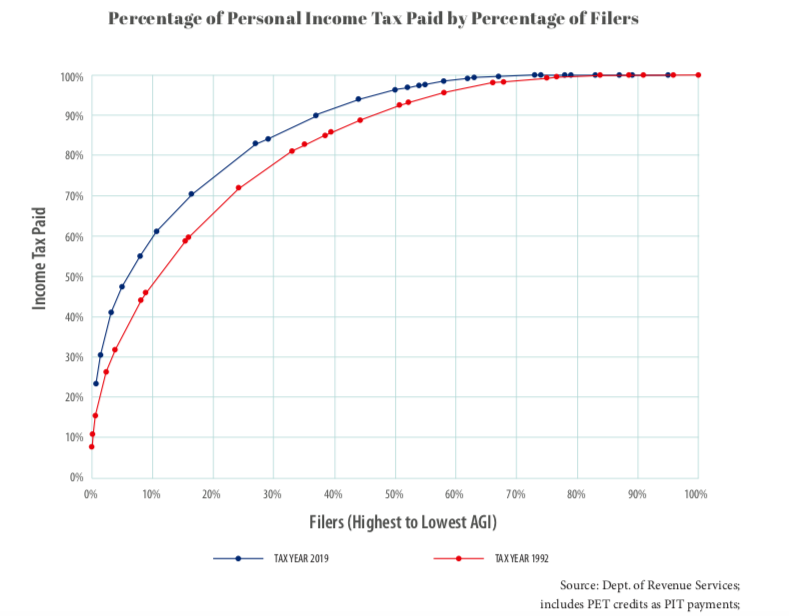

In 1992, roughly half of Connecticut’s income tax revenue came from 12 percent of the state’s population. By 2019, the number of families paying half of Connecticut’s income tax revenue had shrunk to 6 percent, according to the study.

Those high-earners’ income is largely tied to investment earnings, meaning fluctuations on Wall Street can result in dramatic shifts for Connecticut’s budget during market downturns. Historically, governors have turned to tax increases or labor concessions to make up the difference – sometimes utilizing both.

Income tax revenue dropped nearly 15 percent following the 2008 recession and spurred tax increases, largely on high-income earners, in 2009, 2011 and 2015 as the state faced massive budget deficits and struggled to recover economically.

By 2019, Connecticut’s income tax revenue was still $500 million short of where lawmakers thought it would be in 2012.

Another dramatic drop in income tax revenue came in 2017, leading to a nearly $5 billion budget deficit and pushing Gov. Dannel Malloy to seek another round of concessions from state employee labor unions.

Naturally, the opposite can be true as well. During the COVID-19 pandemic, gains on Wall Street have facilitated better-than-expected income tax revenue for the state, while masking an underlying loss of jobs and economic output that may take many years for the state to recover.

Numerous lawmakers, labor groups and policy organizations are now leading a push to increase income taxes on Connecticut’s wealthy, including raising the top rate, adding a surcharge to capital gains and instituting a statewide property tax on homes assessed over $330,000.

Proponents argue the increased revenue could be used to support struggling cities, education and Medicaid programs and have dismissed concerns among lawmakers that increasing taxes may drive high wealth individuals and families out of state.

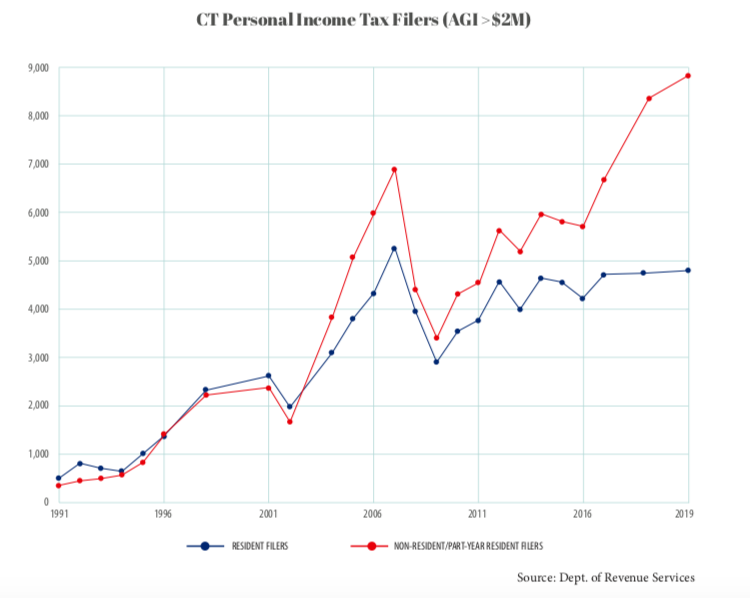

But Connecticut’s rising income tax rates have resulted in a massive shift in non-resident tax filers who earn more than $2 million per year, according to data from Connecticut Department of Revenue Services cited in the study.

The number of non-resident or part-time resident tax filers earning over $2 million per year increased from 35.3 percent in 1992 to 64.8 percent in 2019, meaning more and more millionaires are claiming non-resident or part-time resident status.

Meanwhile, the number of resident filers earning more than $2 million annually has decreased slightly since reaching its peak in 2007.

“Connecticut must break its cycle of leaning on volatile investment income,” study author and Director of Public Policy for Yankee Institute Ken Girardin wrote. “The deleterious effects on the state economy aside, the state cannot responsibly plan to spend money that can vanish with market downturns.”

Despite the push from members of his own party and labor groups, Gov. Ned Lamont has thus far declined to support increasing taxes during this budget cycle.

With Connecticut expecting to receive billions in federal aid money, tax revenues coming in higher than expected and more than $3 billion in the state reserve fund, Connecticut can close expected budget deficits with money to spare.

Advocates for the additional taxes on Connecticut’s wealthy and the statewide property tax, however, say it is a matter of equity – that the rich don’t pay a similar percentage of their income in taxes as lower-income families.

According to Connecticut’s 2014 Tax Incidence Report found that, those earning up $47,948 per year paid an overall effective tax rate of 23.62 percent, while the very few people earning over $13 million per year paid an overall tax rate of 6.28 percent.

However, the type of taxes fell differently on different groups. High-income earners shouldered much of the income tax burden, while the state’s sales tax and property fell harder on lower income families.

The data was based on 2011 tax figures and did not account for more recent tax increases.

As part of his policy suggestions, Girardin says the state should avoid any further tax increases, add a Constitutional amendment limiting tax increases to a 2-year period and conduct its Tax Incidence study every two years, rather than continually cutting the it from the budget.

Mary Ann Overaugh

April 1, 2021 @ 1:01 pm

Cuts are needed! Citizen’s have had to make many cuts to their household budgets. You can’t keep raising taxes without making cuts.

Jesse

April 23, 2021 @ 6:01 am

Come on people a Yankee Institute study! The think tank lap Dog of Connecticut Rich.

Daniel L. Healy, Esq.

April 24, 2021 @ 5:39 am

The easiest way to effect change and balance governing in Connecticut is to elect at least one republican or an Unaffiliated Registered Voter to a Constitutional Office.

Yi is all talk.

Daniel L. Healy, Esq.

April 24, 2021 @ 6:07 am

…Republican …registered voter..

YI is…

Michael Mans

April 24, 2021 @ 6:37 am

The only people who are moving to ct are new yorkers, trying to escape the crime and ridiculous taxes…and illegal aliens, which much of our citizen’s tax money is spent on. There is a reason that the NORTHEAST isn’t a retiree destination and it’s not just cold weather

ANDREW TERHUNE

May 12, 2021 @ 12:12 pm

Some of my best friends here in Florida used to live in CT. Almost all of them are now domiciled here Where the state income tax is 0% and ther is no state inheritance tax.