Connecticut’s fixed costs like Medicaid, debt service and retiree benefits continue to grow faster than state revenue and make up 52 percent of the state’s budget, according to the Office of Fiscal Analysis.

In fiscal year 2021, Connecticut will spend $11.46 billion per year on its fixed costs between the General Fund and the Special Transportation Fund, but that figure is projected to grow to $13.54 billion by 2024 when it will consume nearly 55 percent of the state budget, according to the OFA.

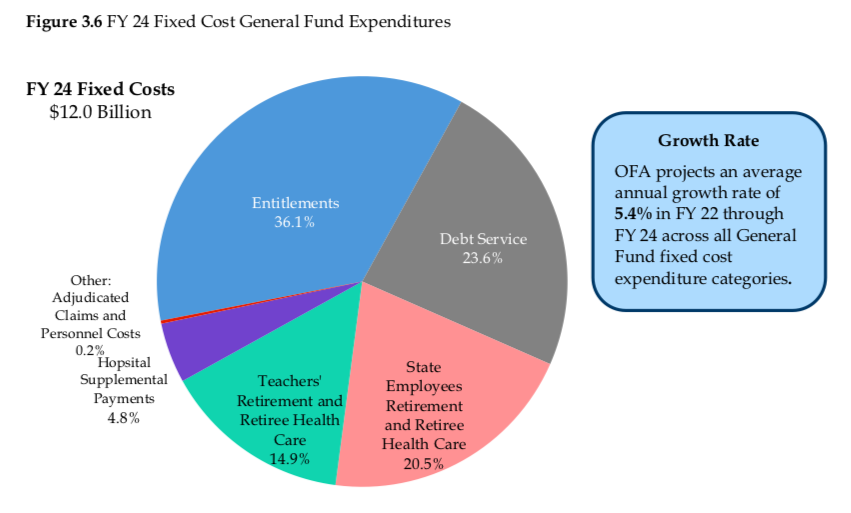

The breakdown of the increased costs to the state’s General Fund between 2021 and 2024 are as follows:

Medicaid/Entitlements: $386.7 million – Medicaid and Community Residential Services represent the largest chunk of fixed costs at 36.1 percent. These increases do not reflect any potential resurgence of the COVID-19 virus which could once again force some people out of the job market and require increased Medicaid services. The total cost of Medicaid/Entitlements will be $4.3 billion in 2024.

Debt Service: $490.4 million – According to the OFA, the primary cause for the increase in debt service is new debt issuance, which accounts for $267.5 million of the increase, and the “backloaded repayment schedule” for pension obligation bonds for the Teachers Retirement System, which will increase by $197.3 million. Connecticut’s total debt service payments will be $2.8 billion by 2024.

State Employee Pensions and Retiree Health Costs: $306 million – While the normal cost for pensions will actually decrease, the unfunded liability costs will increase over the next few years. The increase for retiree health care is primarily due to “increases in the costs of medical and prescription services for Medicare, and non-Medicare, eligible dependents.” Connecticut will spend $2.8 billion on state employee pensions and retiree healthcare in 2024.

Teachers’ Retirement System Cost: $497.9 million – This massive increase in costs is largely due to revised mortality estimates under the state’s latest experience study. This revision is largely responsible for increasing the total unfunded teacher pension liability by $1.3 billion. Connecticut will spend $2 billion on teacher retirement costs by 2024.

Fixed costs paid out of the General Fund also include the settlement between the state and Connecticut’s hospitals for Gov. Dannel Malloy’s hospital tax scheme, which totals $568 million per year. However, the cost will not increase between 2022 and 2024.

The Special Transportation Fund will also see increases to fixed costs paid out of that fund, including $225.5 million in debt service, $81 million for rail and bus operations and $28.3 million in fringe benefit payments. The total fixed cost payout from the STF is projected to be $1.59 billion by 2024 with revenues projected to be roughly $2 billion.

The growth in Connecticut’s fixed costs will continue to outpace estimated revenue growth until 2024, a long-standing problem that creates a structural imbalance in the state’s budget.

Between this year and 2024, “annual fixed growth in projected to be on average $67.5 million more than revenue growth, a seemingly small structural imbalance,” the OFA wrote in its analysis. “Notably, however, the average growth rate for revenue is 2.8 percent while they average fixed cost growth rate is 5.4 percent. This means that more than 100 percent of revenue growth is needed to cover over fixed cost expenditure growth.”

Revenue estimates for Connecticut during the pandemic have seen their ups and downs, with market returns and federal stimulus money helped Connecticut go from a projected $1 billion deficit in fiscal year 2020 to closing out the year with a small surplus.

That trend, however, is not projected to continue and the projected deficits will eat up the state’s entire $3 billion Rainy Day Fund in just two years.

According to the OFA, fiscal year 2021 will have a deficit of $854.5 million, followed by a projected deficit of roughly $2 billion in fiscal year 2022.

If both of those deficits are covered with Connecticut’s reserve fund, it will leave only $91.4 million in savings to address a $2.2 billion deficit in 2023 and a $2.1 billion deficit 2024.

Connecticut’s revenue, which leans heavily on the state’s personal income tax, has proven to be volatile over the years and largely dependent on the financial sector of the state’s economy.

State revenue to the General Fund has grown from $13.2 billion in 2000 to a projected $19.3 billion in 2024, a decrease of .1 percent when adjusted for inflation despite three major tax increases in 2009, 2011 and 2015.

Fixed costs paid out of the General Fund, however, have continued to make a steady climb upward from $5.3 billion in 2000 to now $12 billion by 2024, a 51 percent increase when adjusted for inflation.

Revenue growth is projected to catch up with fixed cost growth in 2024 when revenue growth will outpace fixed costs by $136 million, according to OFA, but these are estimates from several years out that is subject to change in volatile economy struggling through a pandemic.

“There is still a serious concern going forward that a wave of business failure could have a cascading effect on other businesses, the stock market, and the whole economy,” the OFA wrote. “On the other hand, there is some reason to hope that collections will turn out to be better than anticipated.”

“Due to the disparate impact various sectors have on state revenues, the nature of the downturn and which parts of the economy are most damaged or spared will have significant implications for the state’s financial well-being going forward,” the analysis said.

MATTHEW J HARDING

December 16, 2020 @ 3:07 pm

This is a national problem:

“Nationwide, the U.S. state budget shortfall from 2020 through 2022 could amount to about $434 billion, according to data from Moody’s Analytics, the economic analysis arm of Moody’s Corp. The estimates assume no additional fiscal stimulus from Washington, further coronavirus-fueled restrictions on business and travel, and extra costs for Medicaid amid high unemployment.

That’s greater than the 2019 K-12 education budget for every state combined, or more than twice the amount spent that year on state roads and other transportation infrastructure, according to the National Association of State Budget Officers.” –WSJ

https://www.wsj.com/articles/u-s-states-face-biggest-cash-crisis-since-the-great-depression-11603910750

Ray Brodie

January 26, 2021 @ 7:40 pm

these numbers should not be hard to understand. When legislators and public employees use the idea that we can afford that especially when they flunked math and subscribe to the statement ” what do you meen we can’t pay for that, we still have bonds, taxes and funky accounting to pay for it”!

Citizens of Connecticut

Bend over and kiss your own arses goodby!