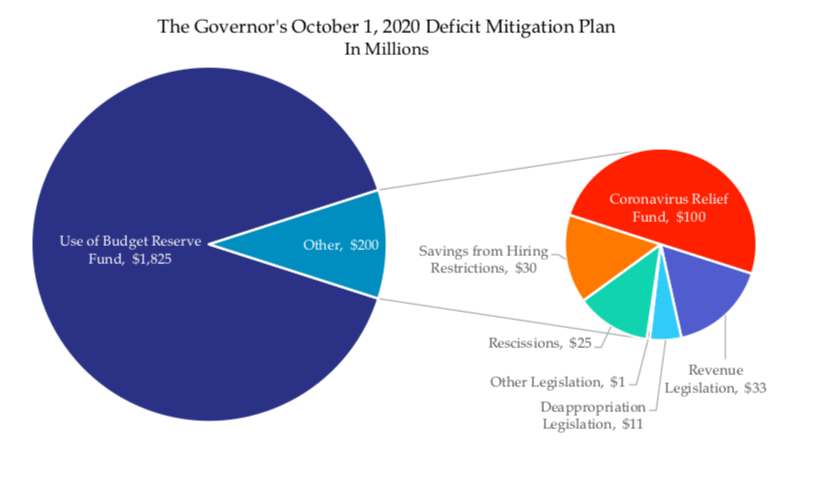

Gov. Ned Lamont submitted a budget proposal on October 1 that draws down Connecticut’s Rainy Day Fund by $1.8 billion, maintains the corporate surcharge tax and implements a hiring freeze to bridge a projected $2 billion budget deficit.

The proposed budget would also take $25 million back from departments and agencies that had lapses in their budgets due to lower than expected costs and utilizes $100 million in federal COVID relief funds.

Although the corporate surcharge tax was meant to expire several years ago, it has been repeatedly extended over budget cycles. Lamont’s budget proposal maintains the tax once again past 2021 to generate $22.5 million.

Additionally, the budget delays the phase out of the Capital Stock method under the Corporation Tax to save $5.7 million.

Lamont also implemented a hiring freeze, leaving non-essential state employee positions vacant for the time being to save $30 million.

The governor’s budget proposal is only for the current fiscal year and some of the proposals will require a vote by the legislature.

However, lawmakers will still be faced with crafting a budget for fiscal years 2022 and 2023 when they return for the legislative session in January.

The draw-down of the state’s reserve fund will leave roughly $1.2 billion in the Rainy Day Fund, but lawmakers will be faced with a projected $5 billion biennial deficit.

Although the governor is recommending taking back lapsed funds across several different agencies, Lamont and budget chief Melissa McCaw have warned state agencies that they will have to find ways to cut costs.

The governor can order state agencies to cut up to 10 percent from their budgets and Lamont has tapped the Boston Consulting Group to find ways to save state money through efficiencies. Boston Consulting Group was also tapped with helping inform the governor’s reopening plan for Connecticut businesses.

However, achieving those savings and efficiencies may be difficult as roughly half of Connecticut’s budget is wrapped up in fixed costs related to Medicaid, pension payments, retiree health care and debt payments.

Although the governor’s current year budget does not necessarily raise taxes, it does maintain taxes meant to expire. But already, major labor groups have been pushing to increase taxes on the wealthy in Connecticut.

New Jersey Governor Phil Murphy and fellow Democrats reached a budget deal in late September that relies on raising taxes by $1 billion, in part, by increasing the tax rate on those making over $1 million per year and extending New Jersey’s corporate surcharge tax to generate $600 million.

New York Gov. Andrew Cuomo, however, backed off his initial threat to raise taxes, saying another tax increase would put New York at a competitive disadvantage with its neighbors, including Connecticut.

“It puts the state at a competitive disadvantage because people can go to other states and taxes are very high in this state to begin with,” Cuomo said.

New York is already seeing an exodus of people moving out of New York City in the wake of the pandemic and social unrest, many of whom are coming to Connecticut.

The state is projecting a 6 percent revenue decrease this year coupled with fixed costs rising approximately $1 billion.

Thad Stewart

October 9, 2020 @ 4:50 pm

Why do politicians in this state refuse to live within their means?

Thad M Stewart

January 31, 2021 @ 7:27 am

In otherwords, he is cooking the books. Hey, did not mobsters go to jail for this?