The newest annual Rich States, Poor States report from the American Legislative Exchange Council dedicates an entire chapter to “Connecticut’s Economic Freefall,” citing Connecticut’s high-tax environment, high pension and debt liabilities and its government labor costs.

The high-profile authors include economists Stephen Moore, who has served in the Ronald Reagan and Donald Trump administrations, and Arthur B. Laffer, creator of the Laffer Curve and former economic advisor to Bob Stefanowski, who campaigned for governor in 2018 on eliminating the state income tax.

Overall, Connecticut ranked 40th in the nation for economic outlook in 2019 but the authors warned the state could drop to 44th based on the $1.7 billion tax increase passed in 2019, which included maintaining the state’s hospital tax and expanding Connecticut’s sales tax.

“With one of the highest overall tax burdens in the nation, Connecticut cannot afford to continually raise taxes without addressing spending,” the authors wrote. “As of this writing, Connecticut’s FY 2020 budget is the largest tax increase of any state.”

Among Connecticut’s issues, the study points to “anemic” growth in annualized gross state product, personal income growth, employment and the loss of tax filers to other states.

Connecticut’s hefty debt burden was the third highest in the nation as a share of gross state product, based on numbers from FY 2016, and Connecticut’s pension funding was placed fourth lowest in the nation by Pew research in 2017.

ALEC’s own state-by-state pension study, Unaccountable and Unaffordable, placed Connecticut’s pension funding as the lowest in the nation when accounting for a risk-free discount rate.

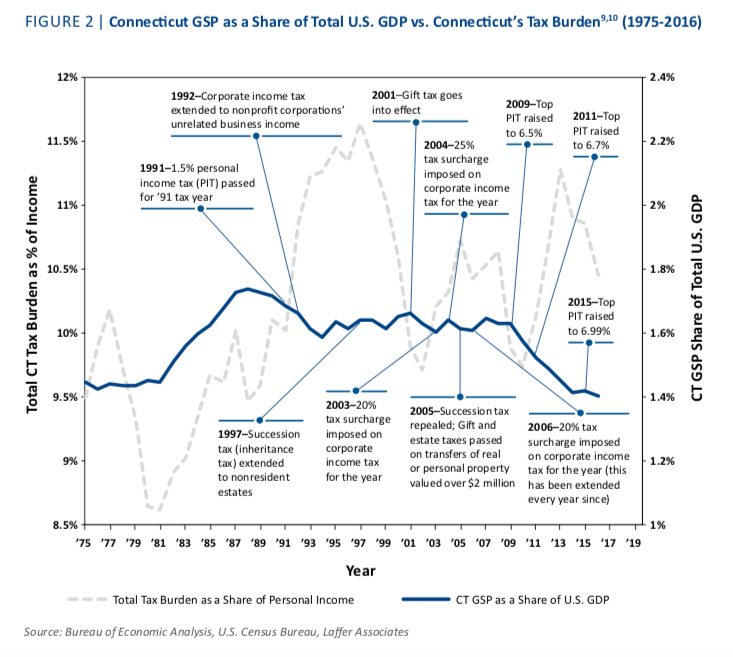

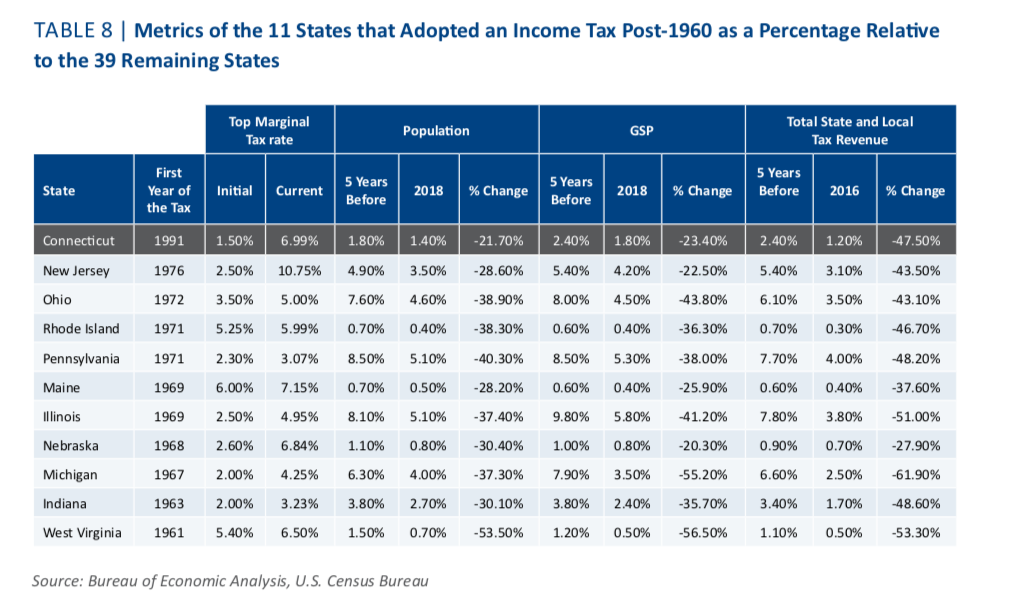

Analysis of the 11 states that have adopted an income tax since 1960 shows Connecticut’s gross state product has decreased 23.4 percent, the population has declined 21.7 percent and state and local tax revenue has declined by 47.5 percent, relative to the 39 other states.

The report also levied criticism at Connecticut’s property taxes, which the authors said, “occupy an outsized share of state and local tax revenues.” According to the report, Connecticut’s home values have not kept pace with the rest of the nation, with an annualized increase of only 1.4 percent since 1988 as compared to the national average of 3.5 percent.

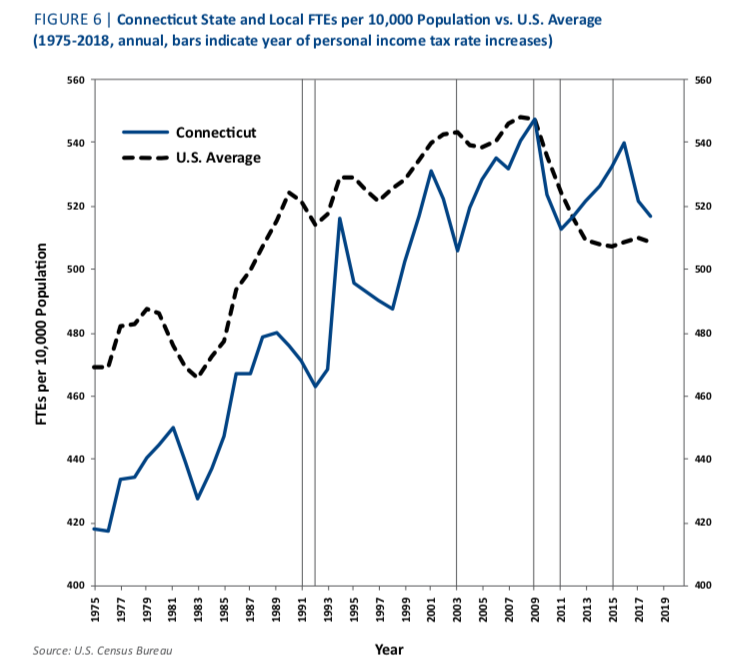

The study also notes that since the implementation of the income tax in 1992, Connecticut’s full-time state and local workforce has increased compared to the national average, and Connecticut’s public employees have the fifth-highest salaries in the country, as of 2018.

In 1992 the state had 50 fewer full-time public employees per 10,000 residents than the national average but by 2016 had 8 more employees than average, although they note that trend has changed recently.

The number of full time public employees per 10,000 residents has grown from roughly 418 in 1975 to roughly 518 in 2019, according to figures cited from the U.S. Census Bureau. Connecticut did not recover all its government sector jobs following the 2008 recession.

Interestingly, the study notes, “since implementing the income tax in 1991, the state ranks 44th in public employee wage growth.”

Connecticut state employees recently received their second general wage increase in two years under a deal negotiated between Gov. Dannel Malloy and the State Employee Bargaining Agent Coalition. It is the fifth wage increase state employees have received in 11 years.

The authors recommend Connecticut reduce its taxes, particularly its personal income and corporate taxes, and cited Massachusetts and North Carolina as models to follow. They also recommend reducing the public workforce through attrition “in order to stimulate private sector growth,” and reforming public employee compensation, including contracting more services to private providers.

Some of that may already be in the works, as the state is anticipating an exodus of state employees by 2022 when cost of living adjustments for pensions is set to take effect and the state has been making some inroads into utilizing more private non-profit organizations to help the disabled.

Connecticut’s property values may also see an upswing – at least in Fairfield County – as New Yorkers are buying up property to get out of the New York City area.

But faced with the economic and fiscal impact of the COVID-19 pandemic, a reduction in taxes might be a difficult sell. Although sitting on a $2.5 billion rainy day fund that can cover next year’s projected deficit, the state will still face a potential deficit of more than $2 billion in FY 2022.

The impact of the on-going pandemic on both the state’s economy and the state’s checkbook in the future remains anyone’s guess.

**This article was corrected to show the metrics of Connecticut’s population decline are relative to 39 other states that have not adopted an income tax since 1960**

Peggy cloutier

August 4, 2020 @ 6:56 pm

I’m born and raised here this is ridiculous how this state keeps taxing us to death and nothing is improving and they. Wonder why people keep moving out

John feher

August 5, 2020 @ 5:04 pm

Sad to of left CT but glad we did..SC is a senior friedlybstate with much to offer a person

Thad Stewart

August 6, 2020 @ 6:18 am

Why do the taxpayers in this state, continually allow this sort of political shenanigans to evolve into an uncontrollable blood lust for more tax dollars? The citizens of this state need to come to the realization that you are severely undermining the chances that your children have to survive and thrive in this once great place to live. Sad, going through life with blinders, thinking it is someone else’s problem to deal with. You are only stymieing progress for future generations.

Donna P

August 9, 2020 @ 12:58 pm

We left CT in 2017 for a more financially friendly state and have no regrets.

Mark Scott

August 10, 2020 @ 3:27 pm

Talk about slow moving steamrollers and CT just stands there waiting to be run over!

The overtime that the state pays it’s employees is excessive.

Any overtime paid to state employees, that flows into a higher pension payment, needs to be eliminated, plain and simple and regardless of department.

State employees need to be laid-off in scores, so they can join their private sector counterparts in the misery that is CT.

Paul Popovich

August 25, 2020 @ 7:23 pm

Absolutely,, Damn commissioners seem to make sure that employees accumulate large amounts of overtime for at least 3 years being the high Thee years are what determines pensions.🤬🤬🤬🤬🤬