Connecticut homeowners pay 20 percent more in property taxes than residents of its nearest neighbors, even as home values in the Nutmeg State have declined, according to a new study released Wednesday.

“As a percentage of housing value, Connecticut homeowners now pay 20 percent more than New Yorkers and almost 50 percent more than their Massachusetts peers,” wrote Jared Walczak, an analyst for the Tax Foundation.

The average property tax millage rate in Connecticut has increased by 29 percent since the implementation of the state income tax in 1991.

The study notes that, nationally, property taxes have increased by 21 percent since 2010, but that increase was underscored by a 10 percent increase in home values.

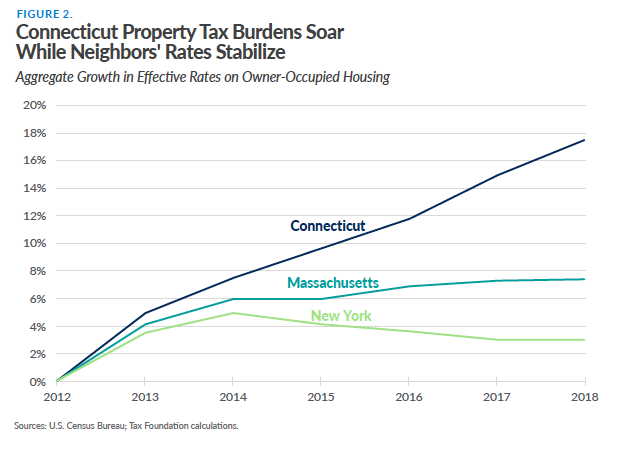

In Connecticut, however, property taxes increased by 19 percent during that same time period, but home values decreased by 3.9 percent. Conversely, property taxes increased 15.8 percent in New York and 10.4 percent in Massachusetts while housing values increased.

As a result, Connecticut homeowners paid an effective rate of 1.7 percent on the value of their home compared to 1.15 in Massachusetts and 1.4 percent in New York.

“Connecticut’s property taxes are uncommonly high – and only getting higher,” Walczak wrote. “This trajectory has persisted for decades, despite efforts to alleviate property tax burdens by shifting to other taxes at the state level, including the adoption of an individual income tax in 1991.”

Property taxes account for the majority of revenue and tax collection for local government, funding local government operations and, largely, schools.

But governments in Connecticut are increasingly reliant on property taxes for revenue. Since 1998, Connecticut’s property tax as a share of state and local tax revenue has increased 4.4 percent, twice the national average.

The study entitled What Can Connecticut Learn from Its Neighbors About Property Tax Limitations, notes that Connecticut residents and businesses often decamp to New York and Massachusetts, even though they are considered high tax states.

However, New York and Massachusetts have something Connecticut does not have: caps on how much their property taxes can increase per year.

Since the implementation of New York’s property tax cap in 2012, property taxes have risen only 3 percent, compared to 17.5 percent in Connecticut. Gov. Andrew Cuomo’s office estimated the cap saved New Yorkers $25 billion.

Since the implementation of New York’s property tax cap in 2012, property taxes have risen only 3 percent, compared to 17.5 percent in Connecticut. Gov. Andrew Cuomo’s office estimated the cap saved New Yorkers $25 billion, although the cap does not apply to New York City and four other “big cities.”

The study recommends Connecticut consider a property tax cap similar to those implemented in Massachusetts and New York to provide taxpayers with not only relief but “greater certainty and predictability in their property tax codes.”

A limit to municipalities’ ability to increase tax revenue through property taxes, however, may not sit well with municipal groups, who face escalating costs at the local level and often reductions in state grants for education and payment in lieu of taxes.

But municipal leaders don’t necessarily want to raise property taxes any further, either.

The Connecticut Conference on Municipalities has been lobbying state lawmakers for relief from costly state mandates and also wants to enable municipalities to collect a wider range of taxes, such as a local sales tax.

A report issued by CCM, called for reducing the state sales tax from 6.35 percent to 6 percent, but creating a statewide 1 percent local sales tax, with the ability for municipalities to impose an additional .25 percent sales tax or 1 percent tax on restaurants and hotels with voter approval.

Property tax caps, however, don’t mean that property taxes can’t increase, but rather limits the amount of the increase depending on what kind of cap is implemented. Voters can override the cap to fund particular projects or allow flexibility for spending increases, giving them a more powerful say in local government spending.

“While any tax can be increased, changes to income, sales, and other major taxes tend to be infrequent and involve considerable debate, whereas property taxes are adjusted frequently, sometimes in the absence of much deliberation,” the study says.

“Given the challenges Connecticut faces with a continued exodus of individuals and businesses, two regional competitors that have embraced greater certainty and predictability in their property tax codes may provide a valuable blueprint for Connecticut policymakers,” Walczak wrote.

Carol

July 16, 2020 @ 7:30 pm

With whats happening in New York I see many NYers moving to Ct to get away from the insanity. Without a cap on our taxes and high cost of living I am looking to move away from Ct. Its not so much sales tax but our property taxes that are out of control.

John Friedson

July 17, 2020 @ 10:10 am

this article is highly misleading! Tax rates vary enormously in Massachusetts. Where I live we paid just under two and a half percent.

Ken Wilson

July 29, 2020 @ 7:46 pm

Thats an average. I live in West Hartford and pay over 3 percent. So not misleading as an average.

Carlton Chen

July 23, 2020 @ 3:18 am

It’s not just real estate and property taxes that need to be considered. For those residents who receive income from Social Security, pensions, and RMDs from retirement accounts, New York is significantly more, and Massachusetts somewhat more, income tax favorable than Connecticut. Unfortunately, real estate prices have markedly declined for many high priced single family homes in lower Fairfield County, Connecticut, sometimes as much as 50% since 2008, while similar homes in neighboring Westchester County, New York and fashionable Boston suburbs have increased by as much since that time. So, financially, it’s difficult for such Connecticut residents to move to neighboring states, even to downsize, without taking a bath. Fortunately, Connecticut’s estate tax exemption recently came in line with its neighbors’.

Accounting Packages

December 11, 2020 @ 2:49 pm

Property tax caps, however, don’t mean that property taxes can’t increase, but rather limits the amount of the increase depending on what kind of cap is implemented. Voters can override the cap to fund particular projects or allow flexibility for spending increases, giving them a more powerful say in local government spending

Pamela Roebuck

January 27, 2022 @ 11:59 am

My husband and I would have loved to buy a second property in our birth state of Connecticut, but the PROPERTY taxes prevent us from doing so. I have no idea why this state keeps electing people who ruin the economy. It is a very sad state of affairs.