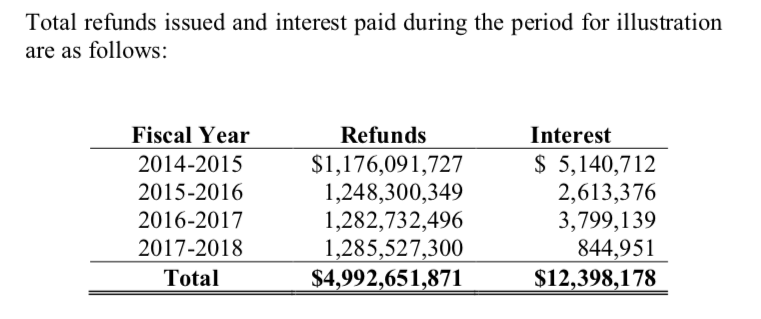

The Connecticut Department of Revenue Services paid more than $12 million in interest for tax refunds totaling nearly $5 billion because they withheld some refunds for upwards of seven years, according to a new audit.

The audit listed tax refunds from years 2014 through 2018 and found that late returns generated massive amounts of interest.

In one instance, three tax returns totaling $1.3 million were held in review after DRS switched to a new system in 2007. The department finally conducted the reviews during the 2014-2015 fiscal year and issued the refunds along with $1.2 million in interest.

In other instances, the refunds were held for over a year which added up to millions in taxpayer dollars being spent on interest payments to individual tax filers. An $8.9 million tax refund generated a $1.1 million interest payment when it was withheld for one and a half years.

“The state continues to incur unnecessary interest expenses when the department does not identify and track returns held for review,” the auditors wrote.

The DRS responded that it is in the process of standardizing its reporting to monitor these claims and noted that one claim in particular was complicated due to a prior audit of the individual in question.

According to the audit, the DRS is required to review tax return payments over a certain threshold to monitor for fraud. State statutes “generally require DRS to pay interest on refund requests held more than 90 days.

The audit also found the DRS was prepaying for postage more than necessary, transferring large amounts of money — over $900,000 in several instances — to its prepaid postage account during the final weeks of the fiscal year.

The department did not report the year-end account balances in its Generally Accepted Accounting Principles reports.

“When prepaid account balances are maintained in excess of reasonable immediate needs, the state loses the ability to use the funds for other purposes and the potential to earn interest,” the auditors wrote.

DRS agreed that the balances in the postage accounts should have been reported, but also said the transfers at the end of the year are to ensure the department has enough funds to inform taxpayers of legislative changes and incentive programs.

“In order to meet the increasing number of accelerated tax changes, the agency will continue to prefund its postage account to meet the tight deadlines imposed in accordance with OPM guidance and Comptroller requirements on reporting,” the department responded.

Thad Stewart

June 29, 2020 @ 6:14 am

The definition of insanity: doing the same thing over and over again, expecting different results. Pretty much sums up the political climate in this financially ruined state.

Christine

December 21, 2021 @ 1:56 pm

My sentiments exactly

Tax return Melton

July 20, 2020 @ 10:06 am

“When prepaid account balances are maintained in excess of reasonable immediate needs, the state loses the ability to use the funds for other purposes and the potential to earn interest,if the refunds were held for over a year which added up to millions in taxpayer dollars being spent on interest payments to individual tax filers. An $8.9 million tax refund generated a $1.1 million interest payment when it was withheld for one and a half years

Thanks

Anthony Wagner

August 31, 2020 @ 4:40 pm

Why is the State of CT paying 12.5% interest on unreturned refunds to whom ever, taxpayers or businesses,

Do the math, 8,900,000.00 Principal x 1,100,000.00 X interest of 12.5 % No wonder why this state is broke in so many ways, we have DEMOCRATIC MORONS running it !!!

nassim taleb

September 3, 2021 @ 10:44 am

hey moron, it is not 12.5%. the payment was withheld for 1.5 years so call it a bit over 8%.