In an email to his constituents on Wednesday, Rep. Josh Elliott, D-Hamden, wrote “there will necessarily be a combination of property tax increases or loss of services,” in Hamden, which has been struggling under crushing debt and unfunded pension liabilities for well over a decade.

Elliott’s email includes a lengthy summary of Hamden’s fiscal problems written by Christian McNamara, Senior Editor and Director of the New Bagehot Project at the Yale Program on Financial Stability and a resident of Hamden.

In the email, McNamara called Hamden Mayor Curt Leng’s budget “profoundly unserious,” and said the town mill rate will have to be raised between 6 percent and 10 percent to meet projected expenses.

Mayor Leng’s budget included only a 2 percent mill rate increase and projected “record high revenue in a number of non-tax categories,” including donations from Quinnipiac University and $6 million in anticipated COVID-19 relief funds, according to McNamara.

“We began the fiscal year with less than $2M in the general fund and are anticipating a deficit of $8 million to $12 million,” McNamara wrote. “In past years we’ve avoided negative fund balances by using money borrowed for other purposes to cover the shortfall. It would appear we’ve run out of the ability to do so.”

“We need to start having some very difficult conversations about state intervention, Chapter 9 bankruptcy,” McNamara wrote.

A 2018 study by the Yankee Institute found that Hamden was most fiscally stressed municipality in Connecticut, worse off than Hartford, which had narrowly escaped bankruptcy when the state of Connecticut took over payment of the city’s debt.

The town’s history of borrowing money to pay pension obligations has resulted in rising costs, necessitating tax increases, and Hamden’s bond rating is approaching “junk” status. Moody’s Investors Service lowered the town’s bond rating in 2019 to Baa3 and its outlook was negative.

McNamara noted the town of 60,000 people faces $22.2 million in debt service and plans to borrow more money to pay off a $18.5 million bond anticipation note to Webster Bank.

“However, as the town’s own financial advisor acknowledged on Saturday, there is very real doubt about whether we will be able to issue bonds given the town’s terrible bond rating and conditions in the market,” McNamara wrote.

We need to start having some very difficult conversations about state intervention, Chapter 9 bankruptcy, etc. If the town cannot be run on the amount of money we have available to us without crippling tax increases, then more serious financial intervention is clearly required.

Christian McNamara, Senior Editor and Director of the New Bagehot Project at the Yale Program on Financial Stability

According to Hamden’s latest pension audit in 2017, the pension fund was only 36 percent funded, bolstered on a $125 million pension obligation bond the town took out in 2015. However, Hamden has continued to pay less than 80 percent of the annual required contribution of $21.9 million.

The town was also failing to meet its 7 percent assumed rate of return on its pension investments.

Given the market downturn this year due to the COVID-19 pandemic, states and municipalities across the country are bracing for negative investment returns, which will add to Hamden’s fiscal problems.

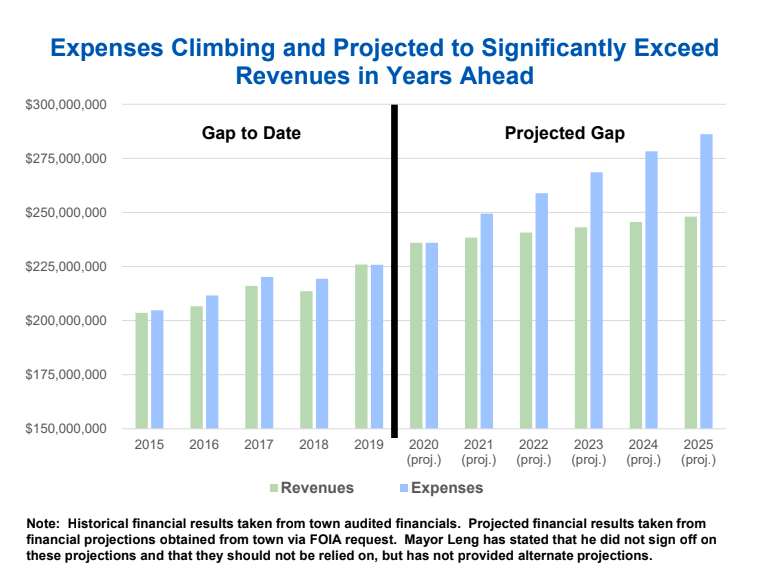

McNamara gave a presentation on Hamden’s dire fiscal outlook earlier in the year during a community discussion, including charts and graphs showing expenses far outpacing revenue by 2022.

Hamden currently has the sixth highest mill rate in the state at 48.86 mills. An increase of 6 percent to roughly 52 mills would bump the town up fourth among high tax municipalities, coming in just below Bridgeport.

McNamara warned a second tax hike mid-year to 54 mills might be necessary if $6 million in COVID-19 relief funding does not materialize.

McNamara implored Hamden’s Legislative Council to impose across the board cuts to keep the mill rate below 50. Barring that, he suggests submitting the town to the state Municipal Accountability Review Board.

The MARB can assume different levels of control over a town’s finances. Currently, municipalities like Hartford, Sprague and West Haven are operating under MARB’s.

I think doing whatever we can do to not be under state control should be a priority. It’s going to hurt people if we have a tax increase.

Rep. Josh Elliott, D-Hamden

“I think doing whatever we can do to not be under state control should be a priority,” Rep. Elliott said in an interview. “It’s going to hurt people if we have a tax increase.”

Elliott said himself and Representatives Robyn Porter and Michael D’Agostino do everything they can to bring back bonding money and Education Cost Sharing money from the state to help support Hamden, but they are competing with 168 other municipalities.

Elliott said there are only a few ways to solve the problem and that includes either revenue increases, spending cuts or streamlining the town government.

“It must be solved at the town level,” Elliott said. “The biggest problem is that we’ve had no transparency, no clarity and no plan from the mayor.”

“We’ve been underfunded for a long time. It can’t be fixed magically,” Elliott said.

In his email, Elliott said he sent out McNamara’s comments so that his constituents would understand the fiscal issues facing their town.

Thomas Esposito

June 4, 2020 @ 7:37 pm

The article says years of miss management. This is accurate. Now some people want money from the federal government to bail them out. But their spending habits haven’t changed, they are still miss managing. There comes a time when you have gone to the waterhole one too many times . The well is dry Mr. Elliott. I don’t know if I will be able to live in Hamden once I retire my taxes are so high. I don’t know what bankruptcy would do, but that should be an option considered and considered by all involved. Then once we start again we should rethink how we make deals concerning pensions. We have to learn that sometimes we just have to say no to certain demands because we don’t have the money to do it. And sometimes you will have to go without services. We need to concentrate on getting our taxes lowered and enticing businesses to come here so we can brighten up our tax pace with businesses and private Residencies that will help to shore up the tax burden.

Bob

June 5, 2020 @ 5:54 pm

Leng needs to resign. Maybe Lamont can offer him a cushy state job just to get him out of Hamden. Then, Hamden needs a charter review commission to seriously reconsider its governance. Dispatch with the office of mayor and replace it with a professional town manager. Switch to nonpartisan elections with ranked choice voting for at-large seats.

David

June 4, 2020 @ 8:45 pm

This has been told over and over to the inept Democratic “leadership”(that’s a stretch) . What astounds me is the total stupidity of Hamden residents for continually falling for the lies and voting for these losers. You know you are screwed when you have to issue pension obligation bonds. No municipality ANYWHERE has ever made out by issuing these. Town needs to: 1. Admit they need MARB intervention. 2. Declare bankruptcy 3. Elect conservative leadership.

Hamdenites cannot afford any more taxes.

David Bouteiller

June 5, 2020 @ 6:28 am

I live in Hamden and it would be ridiculous if you just raised the taxes again nobody could afford that how about getting rid of trash pickup or something like that you got guys in the in the transfer station that don’t do nothing at the time and they just break balls when you go there get rid of them everybody can do their own trash

Andrea Louis

September 22, 2020 @ 9:32 am

Time to really look at what got every one here tax wise in the first place. Cut benefits for town employees

West Woods Resident

June 5, 2020 @ 9:26 pm

Quite honestly, Hamden’s going to have an even bigger problem if they raise taxes and a large group of residents either refuse to pay or just can’t pay… We have insanely high taxes already and it’s just not tenable to increase them further. So Hamden puts additional leins on real estate… Which then becomes more or less worthless in short order because of the town’s mismanagement… It’s pretty sickening to even think about.

We have a young family, we like the town, we’d like to stay but that ability seems pretty unlikely unfortunately.

Junito

June 6, 2020 @ 9:40 am

I lived in Hamden for the past sixteen years. All I have seen taxes go up yearly. Is time to stop voting for people based on party; you need to vote for people whom are going to benefit the town. Suggestion, get rid of garbage pick up or pay for it if you want it, get rid of first responders, I e. Ems, restructure Fire department contracts, switch everyone to 401k plan, and lastly file for bankruptcy. It will allow the state to restructure all the contacts. Union are sinking the town a la Detroit

Jay

June 7, 2020 @ 2:52 pm

“The town was also failing to meet its 7 percent assumed rate of return on its pension investments. “

7%? Really?! Where does anyone get 7% on their money? Only in at a casino or Wall Street can you dream of making 7% and at both places you risk losing everything.

The state also uses this kind of voodoo economic budgeting pugging in pie-in-the-sky numbers like 6.5% to balance the budget.

Disgusted in West Woods

July 1, 2020 @ 2:17 pm

Outa here (moving to another state). Big mistake to move to Hamden in 2010. Bigger mistake to stay. We bought the house from a town cop with 20 years under his belt who has since retired and moved to a “McMansion” in Guilford. Should have known that I would be contributing to his pension at the time.

Cathleen

October 6, 2020 @ 5:28 pm

1. Renegotiate union contracts to freeze salaries and limit benefits.

2. Eliminate pensions for new hires going forward, offer 401k plans.

3. Freeze cola increases to make up for past overpayments due to incompetence of town.

4. Institute departmental cuts across the board.

5. Look at overtime costs and make adjustments.

6. Negotiate with Quinnipiac for direct payments in lieu of taxes.

7. Given current leadership and their inability to stand up to unions or make meaningful fundamental changes, consider bankruptcy to force serious action. Cutting back on services like bulk pickup, which is a drop in the bucket budget-wise, is an insult to residents given current ridiculous tax rates.

Robert S Zapp

December 23, 2020 @ 8:45 pm

Move to Shelton. A red dot in a sea of blue. Mayor lauretti, mayor for 30 years does a great job. Property tax: 23 mills