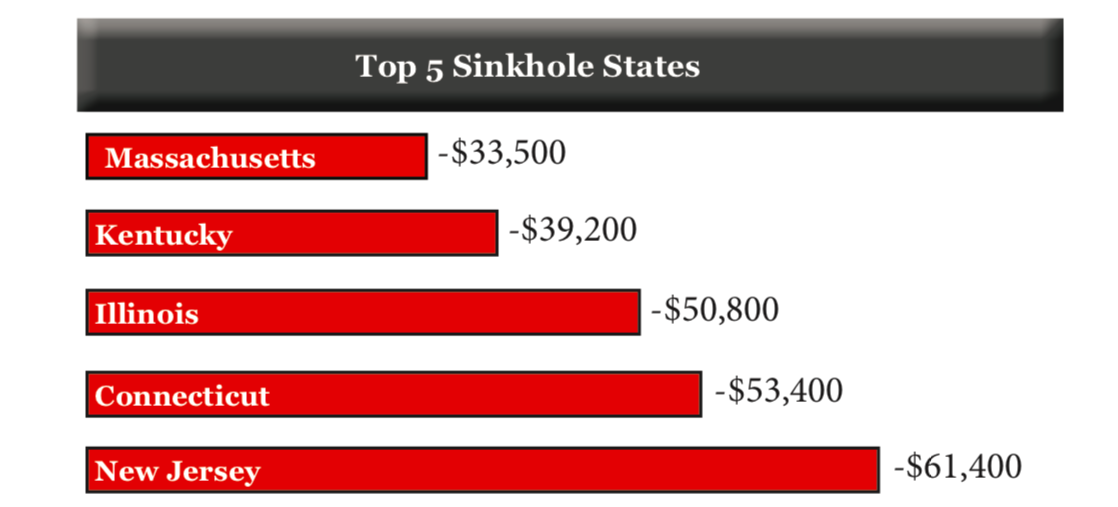

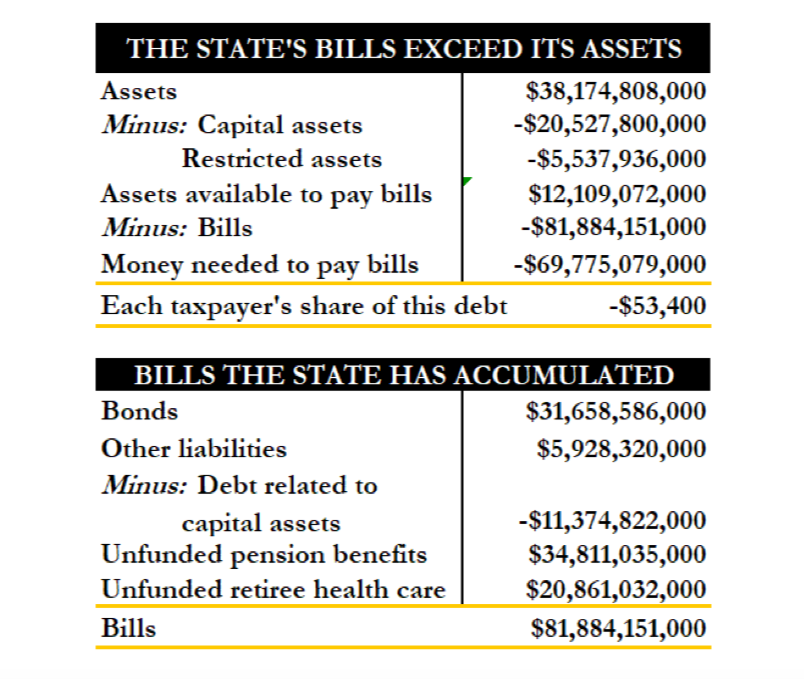

Connecticut ranked 49th in the country in a new analysis of state fiscal health by Truth in Accounting because of its massive taxpayer burden of $53,400 per person, once again labelling Connecticut as a “sinkhole state.”

That figure represents a $3,900 increase in the taxpayer burden from Truth in Accounting’s 2017 report.

According to the report, Connecticut has only $12.1 billion in assets to pay $89.1 billion in bills largely related to the state’s underfunded pension plans and retirement benefits, leaving a $69.8 billion shortfall.

The organization also states that Connecticut has “inflated” its net position because it “defers recognizing losses incurred when the net pension liability increases.”

The report notes that Connecticut decreased its assumed rate of return for its State Employee Retirement System in 2017 from 8 percent to 6.9 percent.

The change, although necessary to ensure better state funding of the pension system, also increased the state’s unfunded liability by lowering its return assumption.

Truth in Accounting noted Connecticut’s bill increased by $6.2 billion, dropping Connecticut from 48th in the country to 49. “The sharp decline in the state’s financial condition corresponds to changes in how its unfunded pension debt is calculated.”

Connecticut also lowered the assumed rate of return for its Teachers Retirement System from 8.5 percent in 8 percent in 2016.

The report said pension and retirement benefits not only represent a significant tax burden for state residents but also give politicians an easy way to hide the costs of government while keeping tax rates low.

“Unfortunately, some elected officials have used portions of the money that is owed pension funds to keep taxes low and pay for politically popular programs,” the report states. “This is like charging earned benefits to a credit card without having the money to pay off the debt.”

Connecticut did not save money for state employee pensions until a state law enacted in 1971 forced full funding of pension costs and required the state to pay off the unfunded liabilities over thirty years.

However, a series of agreements between the State Employee Bargaining Agent Coalition and governors Lowell Weicker and John Rowland overrode the state law, began underfunding the pensions again, extended the payments and changed how the payments were calculated.

While Gov. Dannel Malloy’s administration has made a point to pay the full annually required contribution to fund the pensions, the damage was largely already done. Malloy presided over two large tax increases which, according to both Malloy and Office of Policy and Management Secretary Ben Barnes, have entirely gone toward funding those increased pension costs.

Despite fully funding the pensions and making actuarial changes, the costs for both the State Employee Retirement System and the Teachers Retirement System are set to grow significantly over the next 5 to 10 years.

Connecticut also has some of the highest bonded debt per capita in the country. According to Truth in Accounting, Connecticut’s bonded debt stands at $31.6 billion.

The state borrows extensively for school building projects, transportation, and economic incentives for businesses. The latest round of state borrowing turned heads as Connecticut borrowed on the state’s credit card for a number of projects for its failing cities like a splashpad in New Haven and a grocery store in Hartford.

Connecticut was certainly not alone for its failing financial grade. Ten states received an “F” grade from Truth in Accounting, meaning the state’s taxpayer burden exceeded $20,000 per person.

Connecticut’s neighbor and competitor, Massachusetts, also scored in the bottom five states with a taxpayer burden of $33,500 per person.

Alaska received the top grade in the country with a massive surplus, due to its massive reserve fund.

Truth in Accounting determined the amount of money each state would need to pay its bills and then divided that amount per resident to reach their figures.