Part of the bipartisan budget passed in November included raising teachers’ contribution toward their pensions from 6 to 7 percent, but a bill passed out of the Finance, Revenue and Bonding Committee would roll that contribution back.

Lawmakers used the increased contribution to lower the state’s annual payment toward the teachers retirement system by $40 million in an effort to fix Connecticut’s massive budget deficit.

The Finance Committee received a slew of written testimony from teachers angered at the increase and often questioning Connecticut’s handling of the teacher pension fund, which faces a $14 billion shortfall.

Sen. Art Linares, R-Westbrook, voted against the rollback and says Connecticut will have to ask more from both its state employees and teachers to keep the pension funds from becoming insolvent.

“State government has lied to our state employees and teachers by saying they have retirement security with the way the program works right now,” Linares said in an interview.

Connecticut’s teacher pension costs are part of the rapidly growing fixed costs of state government, which now take up 53 percent of the budget and are growing at more than 5 percent per year, faster than state revenue, which has largely remained flat.

Connecticut is once again facing a deficit year, with an estimated $200 million gap. Reducing the teacher pension contribution will force another $40 million out from the General Fund.

Linares says pension costs are crowding out state spending for other vital services. “Ultimately, as a state, if we want to have retirement security for employees and teachers and also fund infrastructure and schools, we’re going to have to ask for more.”

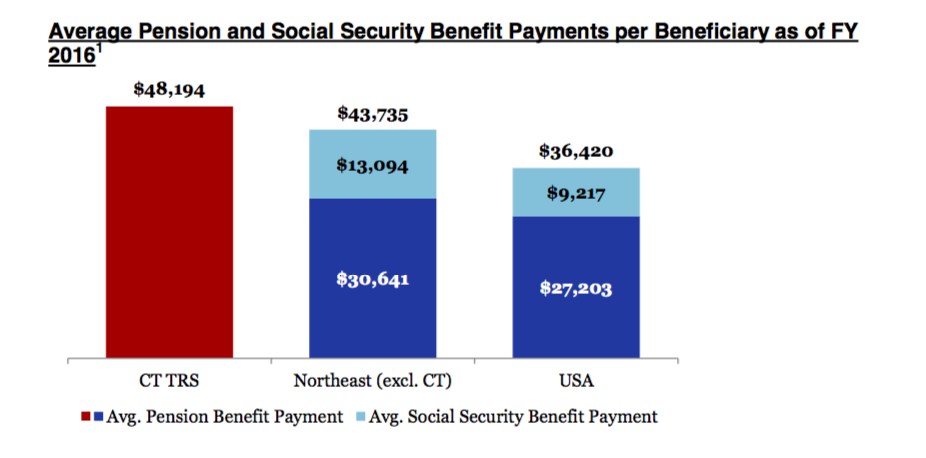

Although Connecticut teachers contribute less toward their pensions than most other states, their pension payouts remain among the highest in the nation, averaging over $50,000 per year, according to a New Jersey based actuary.

Connecticut’s Office of Fiscal Analysis places the average teacher pension even higher at nearly $60,000 per year, although Pew Charitable Trusts pegged the figure at $48,000. Teachers in Connecticut are ineligible to receive social security.

The national average contribution for states which do not allow teachers to collect social security is 8.63 percent. Teachers in Massachusetts contribute 11 percent of their income toward their pensions, while teachers in California contribute nearly 10 percent.

But Connecticut’s teacher unions pushed back against the 1 percent increase in 2017, labelling the measure a “teacher tax” because the increased contribution would bolster the General Fund rather than the retirement fund.

Unlike state employee pensions, teacher pensions are set in statute and can be changed legislatively. But TRS faces a myriad of challenges, the largest being the potential for massive growth in costs over the next decade, which has lawmakers searching for solutions.

Connecticut’s teacher pensions are underfunded by $14 billion and the annual cost to the state is $1.2 billion. That figure is expected to grow year over year. The Center for Retirement Studies at Boston College estimated the cost could grow to $6 billion under the right circumstances.

Both Gov. Dannel Malloy and Connecticut Education Association president Donald Williams have called for a restructuring of the teacher pension debt, similar to what Malloy did with the state employee pension system in 2017.

However, State Treasurer Denise Nappier says that any restructuring of the debt would violate the state’s bond covenant for a $2 billion bond Connecticut took out to bolster the system in 2008.

Malloy also tried to force municipalities to pay for one-third of the teacher pension costs, which was met with considerable backlash from municipalities who said the measure would force them to raise property taxes.

Recently, the Commission on Fiscal Stability and Economic Growth recommended transferring the Connecticut Lottery System to TRS, with the Lottery’s earning going to support the pension fund.

The $300 plus million earned by the lottery system currently goes to supporting a number of state services, so those services would either face cuts or the revenue difference would have to be made up elsewhere.

The Commission also recommended moving new teachers into a defined benefit/defined contribution hybrid plan. The state of Michigan implemented a similar benefits change in 2017, moving all new hires onto a hybrid plan or a 401(k) style plan.

The growth in costs for TRS means that at, some point, some major change will likely be enacted in order to keep the pension fund solvent for vested teachers.

“I think the increase is fair,” Linares said. “And it’s the right thing to do to help fund retirement security.”