Proponents of adding tolls to Connecticut’s highways often point to New York, Massachusetts or New Jersey in an effort to show Connecticut as an outlier, letting potential transportation revenue slip through the state.

But data gathered from the Federal Highway Administration paints a very different picture of highway tolling in other states, how it differs from what some Connecticut lawmakers are proposing, and who would be forced to pay for it.

According to the FHWA, only 22 states use tolls on any of their interstates or bridges, and their use is very limited.

There are 49,244 miles of interstate throughout the United States. Only 3,167 miles of those interstate highways are subject to state tolls — 6.4 percent.

New York is one of the most heavily tolled states in the country, yet only 33 percent of its interstate highway miles are subject to tolls. Massachusetts uses tolls on 139 miles of its 565 miles of interstate highways — 26 percent.

New Jersey tolls only 21 percent of its interstate highway miles.

But Connecticut appears to be considering a much more extensive system of tolling, which would charge motorists on every mile of interstate highway in the state.

Gov. Dannel Malloy, who is pushing for the addition of tolls to Connecticut’s highways in order to increase revenue to the Special Transportation Fund, said it would be up to the legislature to determine the number and location of electronic tolling stations throughout the state.

However, a 2015 study by CDM Smith on the potential for tolls on Connecticut’s highways proposed 78 electronic tolling gantries along all 347 miles of Connecticut interstate.

This would make Connecticut the most heavily tolled state in the nation.

Connecticut is prevented from installing border tolls due to federal highway regulations, but could likely obtain federal permission for congestion tolling within the state.

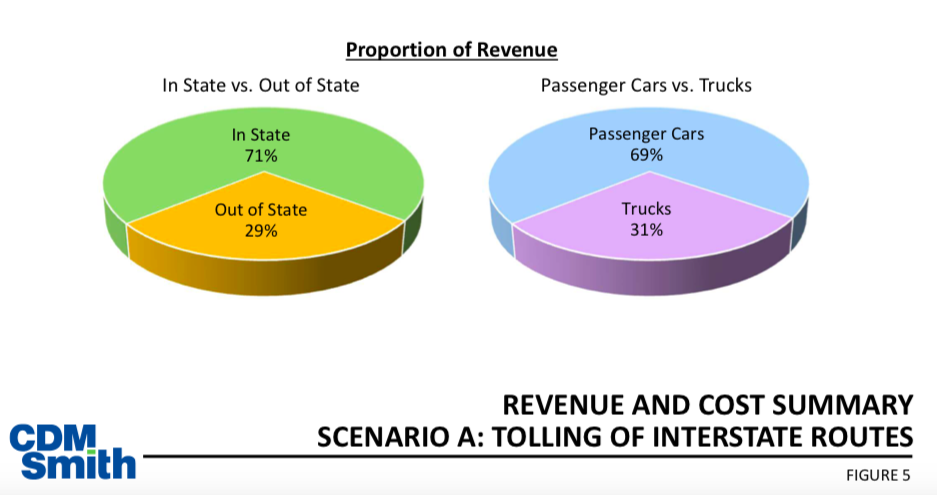

However, congestion tolling means the tolls would largely be paid by state residents. CDM estimated 72 percent of the toll revenue would come from Connecticut commuters — $681 million per year if Connecticut implements a 10 cents per mile rate.

This would mean an additional $523 per year for each of Connecticut’s 1.3 million households.

The cost to Connecticut commuters increases to $1.1 billion per year if Connecticut implements a 20 cents per mile rate.

CDM Smith estimated the cost for installing the electronic gantries at $449 million, plus annual operating expenses of $5 million.

Last year the Connecticut Department of Transportation proposed a slightly more modest 72 tolling locations throughout the state. The DOT included tolling on both interstates like I-84 and I-95 as well as Routes 8, 2, 9, and 11, which would place a greater burden on in-state drivers, according to CDM Smith.

Malloy also proposed increasing the state gasoline tax and adding a tire tax in order to support the Special Transportation Fund.

James

January 28, 2019 @ 9:52 pm

Why doesn’t old Ned find his balls and go after the real problem the union pension that is killing our state and stop taxing us to death