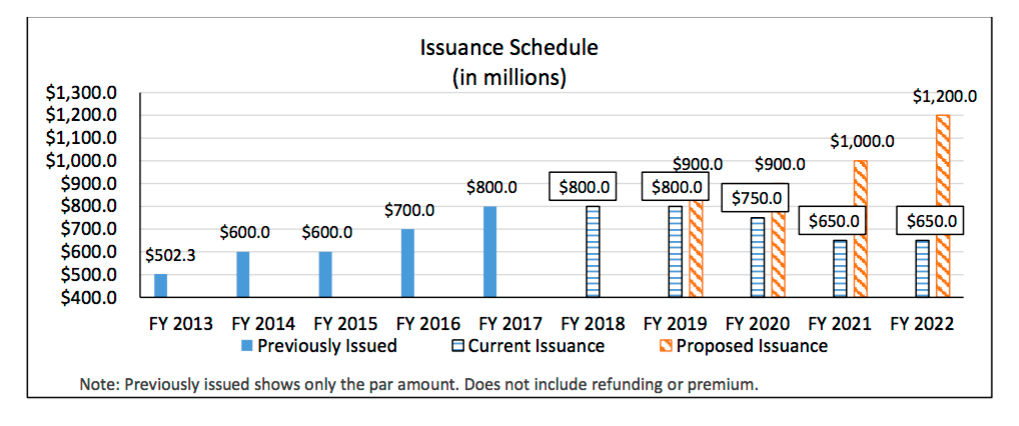

Establishing tolls along Connecticut’s highways and increasing the state gasoline tax by 7 cents per gallon would allow the Special Transportation Fund to issue $1.2 billion in bonds in 2022, up from $800 million this year, according to Governor Dannel Malloy’s budget proposal.

The governor’s plan to institute tolls on Connecticut’s highways, raise the gasoline tax and create a tire tax, has been met with some support in the legislature but mixed reactions in the public.

In January the governor announced that 400 state-funded projects would be delayed indefinitely because the STF would no longer have enough revenue to meet its growing expenses. Debt service payments for past projects and operating costs are projected to grow more than $500 million in the next five years.

This deficit meant the STF would have to limit its bonding to $3.7 billion, with most of those funds going toward Malloy’s Let’s Go CT! project.

The increased revenue from tolls and the gasoline tax would essentially allow the STF to continue bonding at previously planned levels, adding $1.2 billion in 2023, when the tolls would be up and running if they are approved by the legislature.

Currently, due to the suspension of projects, Connecticut is only scheduled to bond $650 million in 2023.

The governor’s proposed budget estimates between $600 and $800 million per year would be collected through electronic tolling and said that it is “imperative to move forward now in order to allow time for the design and buildout required.”

The increase to the gasoline tax would be phased in over five years and is estimated to bring in $105 million in 2023 when it is fully implemented.

The $3 tax on tires is estimated to generate $8 million per year.

The governor also proposed eliminating the School Bus Seat Belt Account to add an additional $2 million per year to the STF. The governor states the account “no longer serves its original purpose.” The seat belt account has continually been used to fill budget gaps in the past.

In total, between the new taxes and tolls, Connecticut residents and commuters would be paying an additional $915 million per year, which would then be used to pay for additional state borrowing.

The governor said the increased revenue will prevent rate hikes and service cuts for Connecticut’s bus and rail service and allow the state to move forward with previously planned projects.