Pension and healthcare costs for employees with the Department of Transportation grew nearly $30 million over three years, increasing operating costs for Connecticut’s beleaguered Special Transportation Fund.

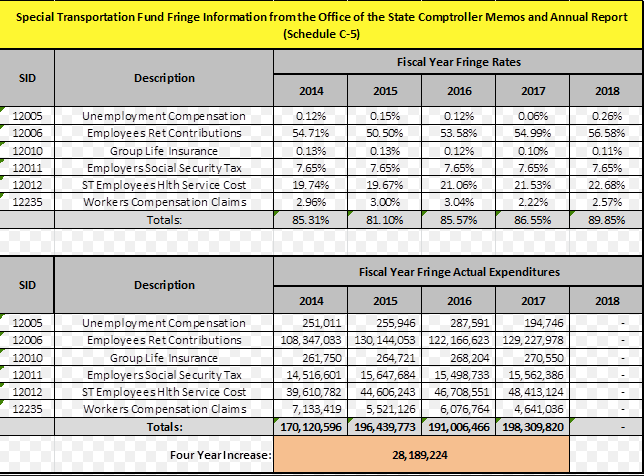

According to figures from the State Comptroller’s Office, between 2014 and 2017 state pension contributions increased $20.9 million, while healthcare costs increased $8.8 million.

Some costs — like worker’s compensation and unemployment compensation — actually decreased during that same time period.

Total fringe benefit costs totaled $198 million in 2017, and the 2018 figures may be higher, according to information presented to the Commission on Fiscal Stability and Economic Growth.

A historical summary of the Special Transportation Fund’s growth presented by Joseph Sculley of the Motor Transport Association of Connecticut, showed fringe benefits and accruals totaling $201 million for 2018.

For perspective, Connecticut appropriated $173.3 million for rail service and $156.3 million for bus service in 2018.

Fringe benefit costs for employees amount to 89 percent of payroll, up from 85 percent in 2014. Of that figure, 56 percent of payroll goes exclusively toward pension costs due to the massive liabilities the state has incurred in its State Employee Retirement System.

Connecticut’s pension liabilities far outweigh the normal cost for pensions. The normal cost — what the state would have to pay if it had no pension liabilities — is $365 million. However, the liabilities add $1.2 billion to Connecticut’s total pension payments, driving up the state’s fringe benefit costs for employees.

Connecticut’s pension payments toward SERS amount to more than the Special Transportation Fund’s yearly budget and both are projected to continue growing.

The state’s Special Transportation Fund has received renewed focus following Gov. Dannel Malloy’s announcement that 400 state projects would have to be put on hold “indefinitely” because the STF was projected to run out of money.

Surging debt costs from past projects are projected to grow $326 million between 2018 and 2022, according to a report by the Office of Policy and Management.

However, operating costs are also growing at rapid rate and are projected to increase $221.9 million during that same time period.

Although the pause in state-funded projects will keep the STF afloat for the next four years, some lawmakers are saying the fund needs more revenue.

Rep. Jason Rojas, D-East Hartford, indicated that he would propose a bill to increase the state’s gasoline tax, and state Democrats are pushing for tolls on Connecticut’s highways in order to grow revenue for the STF.

Despite the pause in various state-funded projects, the STF is still moving forward with $3.7 billion in bonding over the next 5 years for Gov. Dannel Malloy’s $100 billion Let’s Go CT infrastructure initiative.