Only sixty-five cents of every tax dollar actually goes toward funding Connecticut’s state government, the rest goes toward supporting the “legacy costs” of massive debt, pension and healthcare costs.

That fact was pointed out by former Webster Bank CEO and co-chair of the Commission on Fiscal Stability and Economic Growth, Jim Smith, during an extensive hearing on the various difficulties — both fiscal and economic — facing Connecticut.

The panel of business and organizational leaders, which has attracted a lot of media attention, heard presentations from a number of groups including the Yankee Institute for Public Policy, the Connecticut Business and Industry Association, the Department of Social Services and CT Voices for Children.

Smith prefaced the meeting by pointing out that the state of Connecticut’s structural problems show no sign of going away without meaningful reforms.

“We know that there are structural deficits of about $1 billion or so and since spending is growing faster than revenue at this point, it looks like that is going to growing by four or five hundred million per year if there isn’t some kind of structural reform,” said Smith. “And we know we cant have economic growth without fiscal stability.”

Those structural reforms are almost entirely tied to the state’s labor policies, said Carol Platt Liebau, president of Yankee Institute.

“Connecticut’s primary challenge is its dysfunctional relationship with its government unions,” Liebau told the commission. “This is the fact: any successful effort to address Connecticut’s challenges will first require a real reform of our state labor laws.”

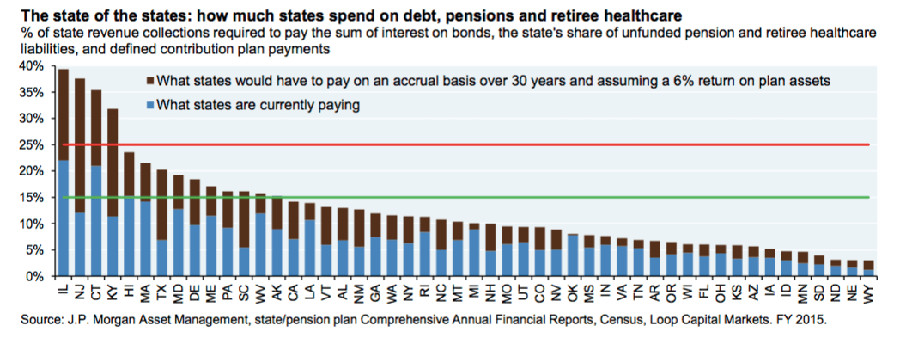

The commission examined a number of metrics showing that Connecticut’s pension and healthcare liabilities have reached levels that threaten to destabilize the state. In particular, a report by J.P. Morgan showed Connecticut as one of only four states whose debt costs were over 25 percent of the state’s revenue.

But addressing those problems could prove difficult due to the over-arching SEBAC contract, which was extended to 2027 as part of the concessions agreement negotiated by Gov. Dannel Malloy and union leaders.

Although the concessions agreement increased employee contributions and established a new tier for new employees, the contract continues to place new employees into the failing pension system.

According to an actuarily backed study, moving new hires into a 401(k) style defined contribution plan, limit the amount of overtime that can be counted toward pension payments and limiting cost of living adjustments could save the state significant money in the future.

The debt, pension and healthcare costs — known as “fixed costs” — have been the fastest growing expense in state government and is outpacing tax revenue. Payments toward state employee pensions is projected to grow from $1.56 billion this year to $2.2 billion by 2027.

Gov. Malloy restructured the payments toward the state employee pension debt in 2017 to keep the payments from spiking to unsupportable levels. This refinancing stretched the payments out until 2046.

Teacher pensions face a much more difficult future and could grow to $6 billion per year if the state does not meet its discount rate. Unlike state employee pensions, teacher pension are set in statute and can be changed legislatively.

Yankee Institute’s Director of Public Policy Suzanne Bates pointed out that Connecticut’s teachers pay much less toward their pensions than teachers in Massachusetts. Connecticut teachers pay 7 percent of their pay, while teachers in Massachusetts pay 11 percent.

Bates suggested that allowing teachers to collect social security could help Connecticut make reforms to the pension structure.

In a similar hearing Monday, representatives from the Connecticut Conference of Municipalities also recommended Connecticut end the practice of collective bargaining for retirement benefits and reform its binding arbitration laws to enable towns and cities to better balance their budgets.

Yankee Institute referenced a forth-coming study, which scored all 169 Connecticut municipalities, noting that 8 Connecticut municipalities are in severe financial distress and 61 are considered unhealthy. Binding arbitration laws often leave municipalities having to pay more than they can afford for wage and benefits contracts.

But the focus on Connecticut’s fiscal problems and how those problems relate to labor, has not sat well with union leaders.

President of the Connecticut AFL-CIO Lori Pelletier said she was “disappointed” that government unions did not have a representative on the commission, even though they hold their labor negotiations in secret, and, in the past, most of their contracts have passed without a vote in either chamber.

Labor’s absence from the commission is a bit of a mystery as they had many opportunities to have a representative on the panel. Union-friendly legislative leaders like Sen. Martin Looney, D-New Haven, and House Majority Leader Matt Ritter, D-Hartford, made appointments to the commission.

Even Speaker of the House and AFSCME employee Joe Aresimowicz, D-Berlin, appointed a member.

Aresimowicz’s boss, Sal Luciano, reacted to the suggestion that Connecticut needs to reform the way it sets pensions and benefits, saying that it will be “taking money out of the hands of working people.”

Currently, 46 states set benefits — either pensions or retiree healthcare or both — in statute requiring a legislative vote, rather than private negotiations with the governor.

Liebau said she recognized that these issues are “politically charged” with “powerful interests that are very invested in the status quo.”

Union leaders have repeatedly called on the legislature to raise taxes to meet Connecticut’s growing expenses, despite diminishing returns after major tax increases in 2011 and 2015.

But the commission appeared skeptical of the idea that raising taxes will fix Connecticut’s ongoing problems. “We’re in a bit of straight-jacket here,” Smith said. “We can’t tax out way out of it.”

Commission Co-Chair Robert Patricelli said, “If the state of Connecticut were a municipality, it would be under an oversight board right now.”